Wholesale Property Funds proudly identifies homegrown opportunities in Perth.

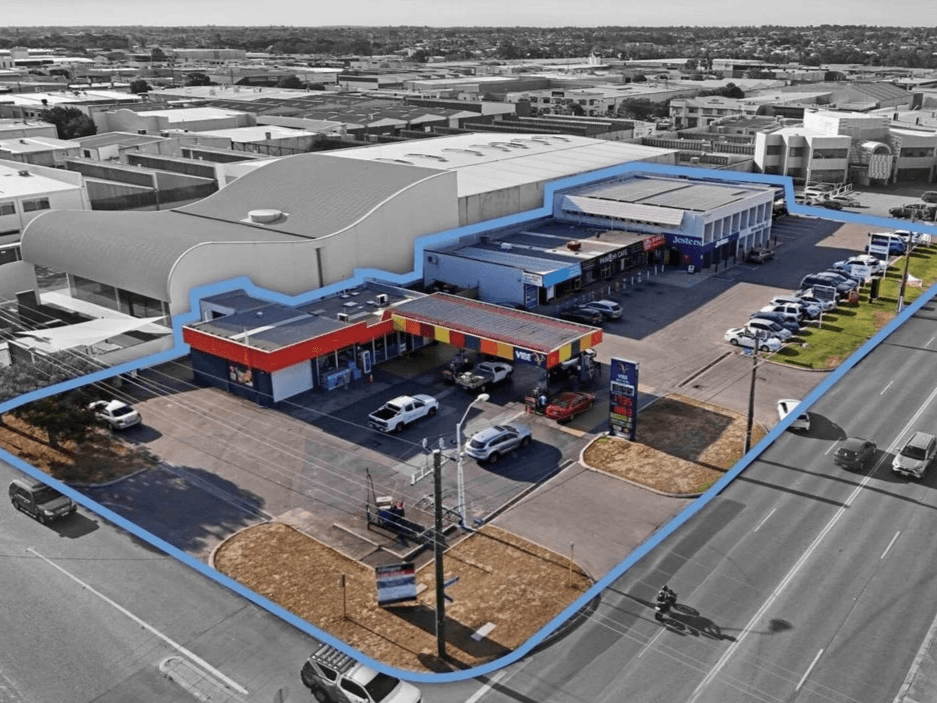

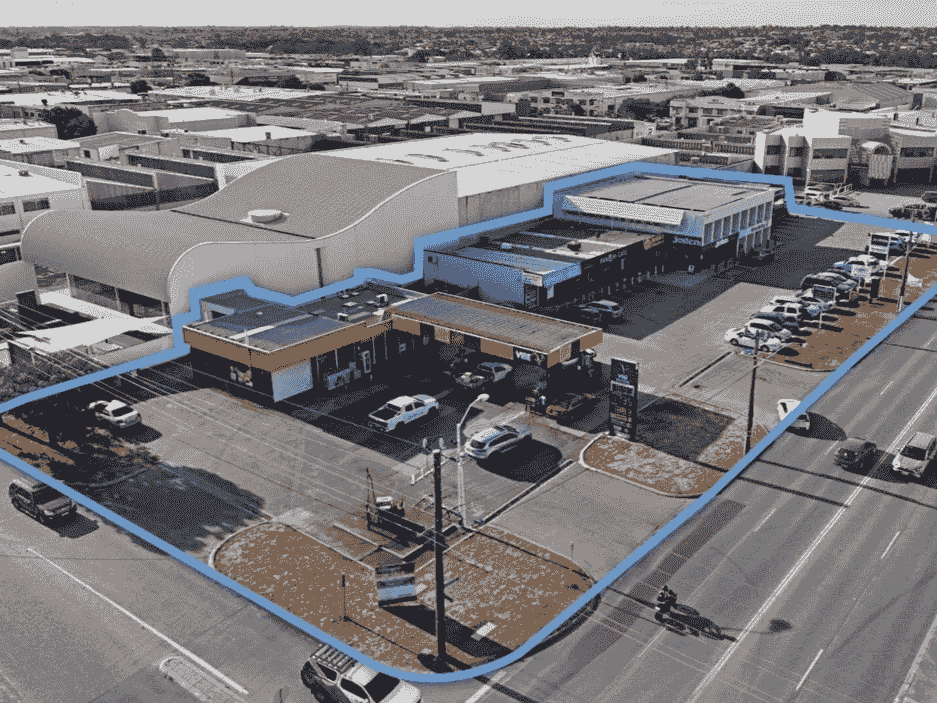

- Commercial Property Funds

- Residential Property Development

Outperform the market you're familiar with... Perth

There are over 12.2M properties in Australia, it's easy to overlook the best opportunities if you don't drill into the details.

WPF's superior Perth know-how uncovers commercial & residential developments others overlook.

Expertly managed by a local, experienced and accessible team.

KENT CLIFFE

Kent has spent the last 15 years sourcing opportunities for ASX-listed clients and various family offices. Kent has been inducted into the Real Estate Institute of Australia's Hall of Fame for his outstanding contributions to the Australian real estate industry.

ANTHONY MCNAMARA

Anthony leverages his role as a commercial property buyers agent with a sister company to identify opportunities for WPF. Prior to property he has 20 years of experience in delivering offshore engineering projects

DAVID ELLWOOD

David has a career spanning all facets of the commercial property and funds management industry. David has been responsible for setting up and delivering various commercial property funds, including holding executive roles.

OLIVER THOMPSON

Oliver has held various roles in the property industry and on the commercial team of ASX-listed organisations. Oliver focuses on supporting the team in due diligence, feasibility studies and fund administration.

WPF Funds

Our funds offer Wholesale Investors access to superior Perth property investment opportunities. Many passive commercial property funds track the market and deliver 7% distributions. WPF seeks to exceed this benchmark by focusing on value add commercial or residential development opportunities.

High initial distribution with various untapped avenues for income growth and upside in constrained market due to high build costs. The 50-key Motel is a substantial landholding of 5,070m2 in WA's largest regional city, Bunbury.

- 14% p.a average yield, distributions paid quarterly

- 18% target IRR

Fund: Closed

Pier 21 Marina - Marine Infrastructure

This fund acquired the existing Pier 21 Marina with plans for a comprehensive ~ $10M redevelopment which will position Pier 21 Marina as one of the premier marinas in Perth. The investment premise is to capture the development upside and hold and operate the business to provide a strong ongoing yield to investors over many years.

- ~18% annual distributions post development

- ~85% Projected uplift on value post completion

Fund: Closed

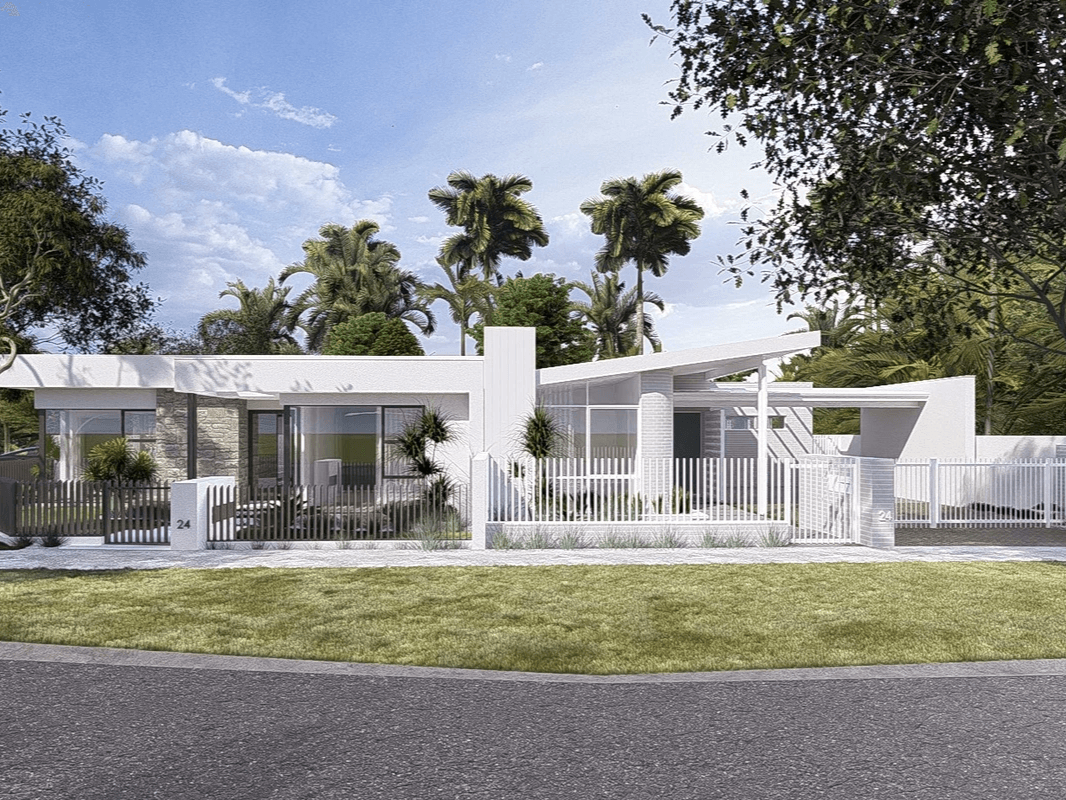

Peppermint Grove Residential Development

A $2.5M equity fund for the construction of a boutique residential development in Peppermint Grove. The project term is 20 months, and the total project end value was $6M with expected completion in mid-2025.

- 25% preferential return (ahead of the developer)

- plus 50% of performance above 30% p.a.

Fund: Closed

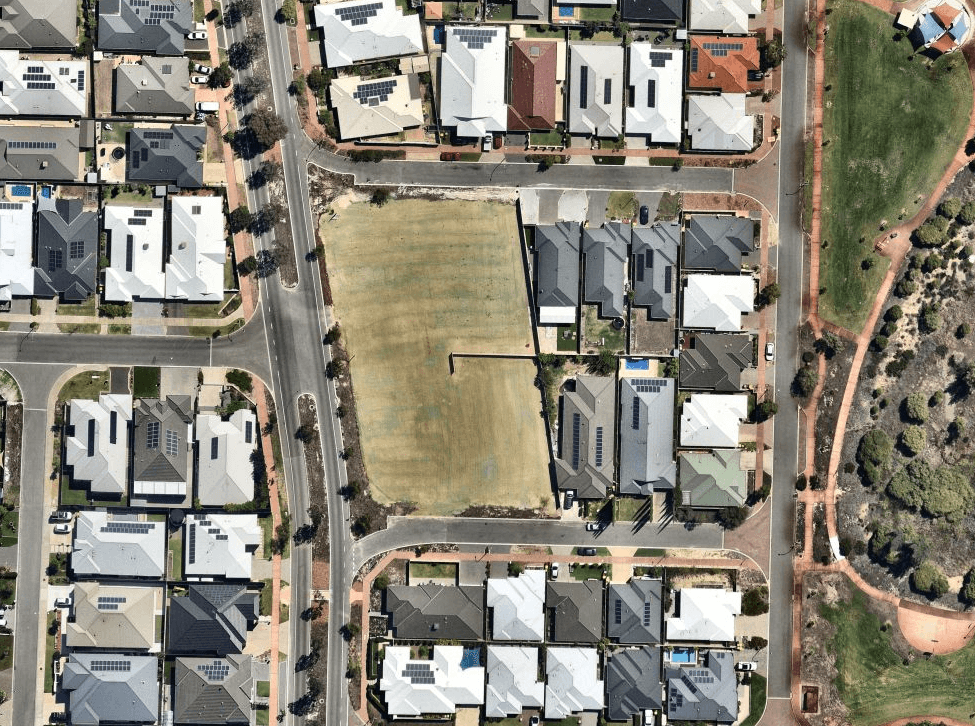

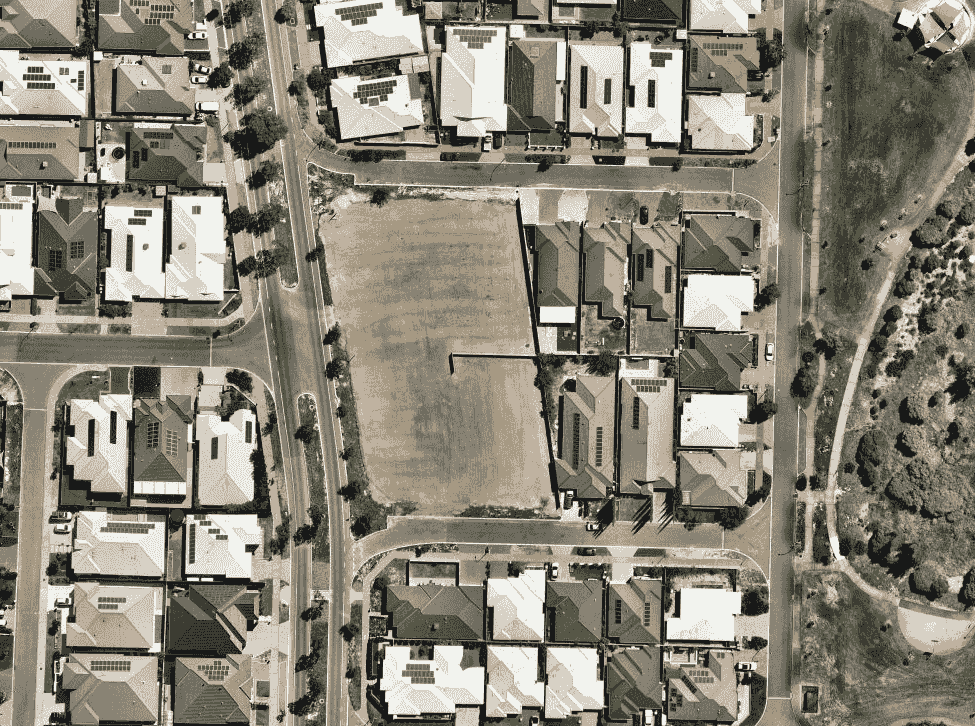

Caversham Residential Land Development

A $1.5M debt fund for a 12 lot residential infill land subdivision. The loan was a second mortgage over 18 months on an LVR below 77%.

- 15.27% p.a. IRR on funds invested

Fund: Closed

Contact

Funds only available to Wholesale Investors.

WP Funds Pty Ltd (ABN 59 679 922 180) Trading As Wholesale Property Funds

5/1076 Hay Street, West Perth Western Australia 6005